Headlines abound about the end of the dollar’s global domination. Russia is embracing Chinese renminbi-denominated trade. So is Brazil. Saudi Arabia is starting to invoice its oil exports to China in renminbi too. Russia and Iran have integrated their banks. Sanctioned by the US, both these countries are settling trades in rubles or rials. Talk of BRICS countries planning a new reserve currency is rife. Even India is settling some trade in rupees.

For years, doomsdayers have been trumpeting the dollar’s demise. Once the Japanese yen was deemed a rival. Then, it was the euro. Now, it is the Chinese renminbi, also known as the yuan. Yet these fears are exaggerated. The reason is simple. People invest in the dollar because the American economic model is still the most dynamic in the world. The US has top universities, great laboratories, ease of setting up businesses, investors, depth of markets and culture of innovation are still unparalleled.

Yet the dollar is unlikely to have the same dominance as in the past for a very simple reason. The hegemony of the US was historically unprecedented. Sir Arthur Harris, known as “Bomber” Harris, had bombed Germany into oblivion. The US had dropped two nuclear bombs on Japan. France had been occupied by Germany, and the UK was victorious but exhausted. Russia was still under Joseph Stalin and had been decimated by Nazi Germany.

After World War II, the US was the only game in town, the American economy was 50% of the global GDP, the US was the factory of the world and the dollar replaced the pound to emerge as the top dog. Since then, no other economy has held a candle to the American one. Yet others are on the up, and the dollar’s status is not as dominant as before.

Rivals Emerge but Still Lag Behind

China has risen like a phoenix after two centuries of ignominy. It, and not the US, is now the workshop of the world. As a result, China is the biggest importer of commodities. Russian gas, Saudi oil and Brazilian soybeans all make their way to this giant Asian market. So, it is only natural that some trade is denominated in renminbi/yuan. As a trade currency, the yuan is picking up. In China’s cross-border transactions, the yuan reached 48.4% and the dollar declined to 46.7% from 48.6% a month earlier.

Yet there is no challenge to the status of the dollar as the reserve currency. There is nothing today that can replace it. For one thing, the yuan is not freely convertible. Under President Xi Jinping, China has tightened currency and capital controls. Even Jack Ma, the richest Chinese entrepreneur, has been brought to heel. Yet convertibility is only one of many shortcomings the currency has, and wealthy Chinese still go to great lengths to take their money out of the country and invest it in real estate in Vancouver, shares in Western companies and plain simple dollars. No American billionaire or millionaire thinks of storing wealth in yuan.

To put it bluntly, China lacks investor protections, institutional quality and capital market openness. The Middle Kingdom also has an opaque banking system with a mountain of non-performing loans, a gigantic real estate bubble, poor enforcement of contracts, and arbitrary and draconian regulations. Yes, China is the top global factory now but it still has not figured out how to create a financial system that is efficient, transparent and trustworthy.

The euro has problems too. The jury is still out on whether the euro will survive in the long term. At the heart of the matter is the fundamental difference between the north and the south. The Greek debt crisis threw the eurozone into disarray. Italy’s burgeoning debt, sclerotic growth and aging population threatens to sink the euro ship.

Furthermore, Europe lacks US-style deep capital markets, banking, fiscal and political union. Will German taxpayers bail out Italian banks? Also, European bond markets are more fragmented and shallower than their American counterparts. There are simply not enough high-quality euro-denominated assets for investors to buy and sell.

Other currencies cannot be challengers. The pound fell from grace many decades ago. Post-Brexit, the British economy is caught in a low-wage, low-productivity and low-growth spiral. Cool Britannia is distinctly uncool these days. India, a fast rising former British colony, is growing impressively fast, but it has a very long way to go before its currency becomes a medium of exchange internationally.

Dreams of a BRICS currency will remain dreams. These economies have little in common with each other. Russia, Brazil and South Africa remain exporters of commodities. China is the global industrial superpower, and India is striving to boost manufacturing after decades of focus on services. Jim O’Neill, the former Goldman Sachs banker who coined the term BRICS for these five countries, has concluded that this proposed currency means little for the US-centered global financial system.

Dreams of gold replacing the dollar run into liquidity issues. The crypto mirage has now well and truly crashed. Other ideas of using a basket of currencies are simply too unwieldy. As yet, there is no alternative in sight to the dollar, flawed though it may be.

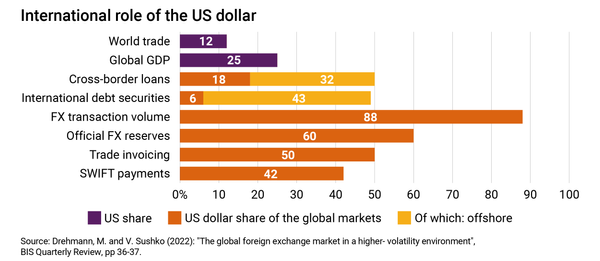

As geopolitical analyst Ian Bremmer wrote, “the dollar continues to be widely used for funding, pricing, trade invoicing and settlement, and cross-border borrowing and lending even when the US is not involved.” A brief look at the graph below tells us all that we need to know about the global importance of the dollar.

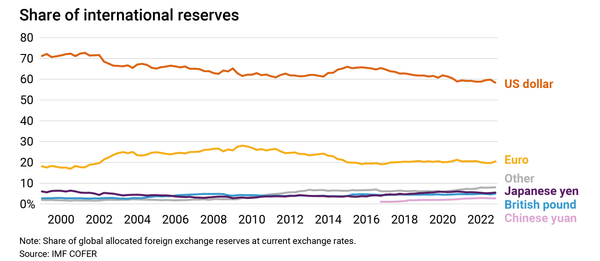

There is also another important statistic that Bremmer touts. Central banks hold $12 trillion in dollars as foreign exchange reserves. This figure has declined since 1999 but “it is still nearly twice that of the euro, yen, pound, and yuan combined – the same as it was a decade ago.” The Chinese yuan comprises a measly 3% of foreign exchange reserves.

Despite the US Federal Reserve following a policy of quantitative easing that dramatically devalues the dollar, China has felt compelled to keep purchasing dollar-denominated assets. Even the weaponization of the dollar against Russia has not forced a change in Chinese policy when it comes to keeping these assets.

The graph below captures the dominance of the dollar as the world’s reserve currency. For all the chatter by analysts, geopolitical gurus and media pundits, this domination is not yet under threat.

The dollar dominates because it is stable, liquid, safe and convertible. As stated earlier, the US is still the largest and most innovative economy in the world. American financial markets are the largest, deepest and most liquid in the world. Assets around the world are denominated in dollars, giving many investment options to those who hold the currency. The dollar also continues to be a safe haven for non-Americans, including people from the BRICS economies.

Top Dog Status Secure but Not Eternal

As stated earlier, the US economy is the largest and most dynamic in the world. American educational, economic and political institutions inspire global credibility and confidence. India’s blue-blooded Indian Administrative Service (IAS) officers who rule the country are willing to give their right arm to send their children to Harvard or MIT, and even Emperor Xi himself sent his daughter to Harvard.

The inherent strength of the US is a cliché that everyone parrots. The US has everything to be top dog from the most powerful military to a robust economy. Innovative companies such as Google, Apple and Tesla sprout up ceaselessly in the US and become dominant global players. Ultimately, people trust the US. They buy into the myth of Harvard and Hollywood, giving the US not only hard power but also what Joseph Nye calls soft power.

Yet all of this trust is also fragile. As we think about the dollar, Americans are playing political football yet again with its debt ceiling. Democrats want to spend like no tomorrow. Republicans cannot countenance any increase in taxes. And the American citizenry has gotten used to pain-free goodies racked up on Uncle Sam’s credit card. Thus, fiscal deficits continue to grow. Quantitative easing, the de facto printing of money, has fueled asset bubbles that are deflating as the Federal Reserve raises interest rates to combat inflation.

Smaller banks are going under and big banks are buying them up. Too big to fail has become even bigger to fail, amplifying moral hazard and systemic risk. The US financial sector is a world leader, but it is not as stable or resilient as it once was. The military-industrial complex demands ever increasing investment, while higher education costs an arm and a leg. Healthcare is stratospherically expensive and yields worse outcomes than economies that spend far less on it. In fact, American life expectancy recently declined and so, too, did social mobility. For too many, the great American dream has turned into the terrible American nightmare, straining the very fabric of society.

If the US continues to fragment, if American democracy keeps becoming even more dysfunctional and if Americans lose faith in their institutions—as many did on January 6, 2021—then the dollar may not remain top dog. Nothing lasts forever. For now though, reports of the dollar’s death are greatly exaggerated.

The views expressed in this article/video are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.